War financing crisis: Russia budget deficit worst since 1999

Russia’s state revenues from oil and natural gas are projected to plummet by almost half in December compared to the previous year, falling to 410 billion rubles ($5.17 billion), driven by declining crude oil prices and a stronger ruble, according to Reuters calculations published Friday.

This steep drop in Russia energy revenue signals growing financial strain on the Kremlin's ability to finance its war.

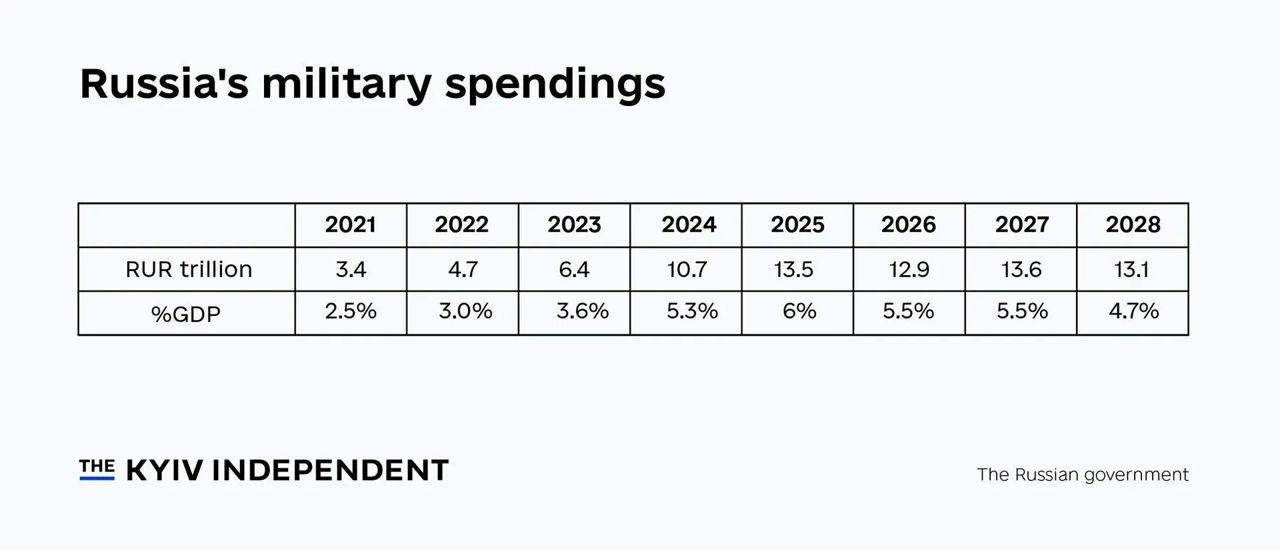

Oil and gas remain the Kremlin's main source of Kremlin funding, historically accounting for about a quarter of the federal budget. However, these receipts are being quickly outpaced by massive, intensified spending on defense and security following the full-scale invasion of Ukraine in 2022.

For the full year, energy sector revenues from oil and gas exports are estimated at 8.44 trillion rubles, nearly 25% less than last year, landing below the Russian Ministry of Finance's own forecasts. Analysts caution that while Moscow can cover the December Russia budget deficit through domestic borrowing, the situation faces a much steeper financial decline starting in 2026 if oil prices remain depressed.

Russia is grappling with a severe budget crisis. According to an analysis prepared for the Free Russia Foundation, a non-profit group focused on democratic transition in Russia, and cited by the Kyiv Independent, opposition economist Vladimir Milov states that the nation’s budgetary situation is "far from normal." He argues, "To keep the military apparatus running requires much more money — and that money simply does not exist."

The report indicates an unprecedented financial stretch: seven consecutive years of a budget deficit over 2% of GDP—a stretch unseen since 1999. The estimated deficit for 2025 has been raised to 2.6% of GDP, and most economists consider projections for 2026 (a drop to 1.6%) unrealistic.

"The deficit is Russia's most serious economic and political-economic problem," Vladimir Dubrovskiy, an economist at the Center for Social and Economic Research in Ukraine, told the Kyiv Independent. He warns that a continued war effort will significantly escalate the deficit, particularly if additional Russian economic sanctions are imposed.

This financial crisis directly impacts Russia's ability to sustain the Ukraine war financing effort. Although the Kremlin promises to keep military spending stable between 2026 and 2028, it has ceased publishing actual budget execution data. Furthermore, the head of the major Russian state-owned defense conglomerate, Rostec, Sergey Chemezov, has admitted that profitability in the arms industry is "close to zero or running at a loss."

Tangible signs of financial difficulty are also emerging at the regional level. Several Russian regions have significantly reduced or cut the financial bonuses offered to volunteers enlisting to fight in Ukraine, reflecting a clear lack of available resources.

With access to international financial markets blocked and the reserves of the National Welfare Fund, Russia's sovereign wealth fund, nearly depleted, Moscow has limited options for financing its deficit. Experts cited by the Kyiv Independent suggest that one of the few remaining solutions is printing money, a highly inflationary measure that risks deepening economic instability.

Ukraine and its Western allies maintain that crippling Russia's energy revenues is essential to weaken Moscow’s war-funding capacity. Ukrainian attacks on oil infrastructure and Western sanctions continue to exert pressure on the Russian economy at a time when the costs of the war are becoming increasingly difficult to bear.

Translation by Iurie Tataru